ASELSAN Achieves Strong Growth, Export Milestones In H1 2025

Turkish defense technology leader ASELSAN has delivered outstanding performance in the first half of 2025, with ASELSAN financial results 2025 showcasing remarkable growth across all key performance indicators. The comprehensive ASELSAN financial results 2025 demonstrate the company’s strategic transformation, featuring an impressive 11.3% real revenue increase to 53.7 billion TL and record-breaking export contracts totaling $1.3 billion, positioning the company as a dominant force in the global defense industry.

Revenue Growth Drives Strong Performance

ASELSAN achieved exceptional revenue growth during the first six months of 2025, with total revenues reaching 53.7 billion TL, representing a substantial 11.3% real increase year-over-year. This impressive performance was fueled by ongoing deliveries across multiple high-technology defense sectors including air defense systems, advanced electro-optics, radar technology, sophisticated avionics, electronic warfare capabilities, comprehensive security solutions, and cutting-edge weapon systems.

The diversified revenue streams reflect ASELSAN’s strategic positioning across critical defense technology segments while demonstrating successful execution of major contracts. This balanced portfolio approach reduces market concentration risks while maximizing growth opportunities across various defense applications.

Record Export Contracts Exceed Expectations

Export performance reached unprecedented levels during the first half of 2025, with direct and indirect export contracts totaling an impressive $1.3 billion, representing nearly half of the company’s $2.8 billion total new contracts. This remarkable export achievement demonstrates ASELSAN’s growing international competitiveness and widespread market acceptance of its advanced technologies.

The total new contract volume of $2.8 billion represents a solid 10% increase compared to the same period in 2024, reflecting sustained global demand for ASELSAN’s innovative defense solutions. This strong contract performance validates the company’s strategic focus on international market expansion while maintaining domestic leadership.

Substantial Backlog Expansion

ASELSAN’s order backlog experienced dramatic growth, expanding by 30% to reach $16 billion, providing exceptional visibility for future revenue generation and business stability. This substantial backlog represents multiple years of secured work, creating a solid foundation for sustained growth while reducing revenue volatility concerns.

The robust backlog growth demonstrates strong customer confidence in ASELSAN’s delivery capabilities, technological leadership, and reliability. This extensive order book positions the company for continued expansion while providing financial predictability essential for long-term strategic planning and investment decisions.

Outstanding Operational Performance

EBITDA from operations reached 13.5 billion TL with an impressive 25% margin, representing a remarkable 15% real increase compared to the previous year’s first half. This exceptional operational performance demonstrates ASELSAN’s ability to maintain strong profitability while simultaneously scaling operations and investing heavily in future capabilities.

The Book-to-Bill ratio of 2.0 positions ASELSAN significantly above industry averages, indicating healthy demand dynamics and highly effective order conversion processes. This outstanding metric reflects the company’s competitive strength and widespread market acceptance of its technological innovations.

Massive R&D Investment Strategy

Research and development expenditures surged by an impressive 42% compared to the previous year, reaching $572 million during the reporting period. This substantial R&D investment demonstrates ASELSAN’s unwavering commitment to maintaining technological leadership while developing next-generation defense capabilities that meet evolving global security requirements.

Infrastructure investment doubled year-over-year, reaching $104 million and representing a 100% increase compared to the same period in 2024. These significant infrastructure investments support expanded production capacity and enhanced manufacturing capabilities essential for meeting rapidly growing international and domestic demand.

Strengthened Financial Position

Net debt decreased by 38% compared to the previous year’s first half, resulting in significant improvement in the Net Debt/EBITDA ratio, which dropped dramatically from 1.21 to 0.57. This substantially improved financial position provides enhanced operational flexibility while significantly reducing financial risk exposure.

The strengthened balance sheet enables ASELSAN to pursue aggressive growth opportunities while maintaining financial stability and independence. The reduced debt burden also enhances the company’s ability to invest in strategic initiatives, advanced technology development, and international expansion efforts.

CEO Identifies Success Factors

ASELSAN CEO Ahmet Akyol highlighted three critical factors driving exceptional performance: strategic focus on high-technology products with rapid product launches, comprehensive efficiency improvements across operations, and extensive localization efforts throughout the supply chain. These strategic pillars have created sustainable competitive advantages while reducing dependency on external suppliers and enhancing cost competitiveness.

During the first six months of 2025, ASELSAN successfully introduced eight innovative new products to inventory for the first time, demonstrating exceptional innovation capabilities and rapid development cycles. The strategic integration of artificial intelligence into business processes generated substantial $25 million in annual savings while significantly improving operational efficiency.

Productivity Enhancement Despite Expansion

Despite significant workforce expansion to support growing operations, ASELSAN improved revenue per employee by 1.6%, demonstrating enhanced productivity through advanced technological integration and comprehensive process optimization. This productivity improvement reflects successful implementation of efficiency initiatives while effectively scaling operations to meet increasing demand.

The company’s strategic focus on localization efforts with domestic suppliers created significant cost advantages while strengthening Turkey’s defense industrial base. These partnerships enhance supply chain resilience, reduce costs, improve delivery performance, and support national defense independence objectives.

Technology Leadership Demonstration

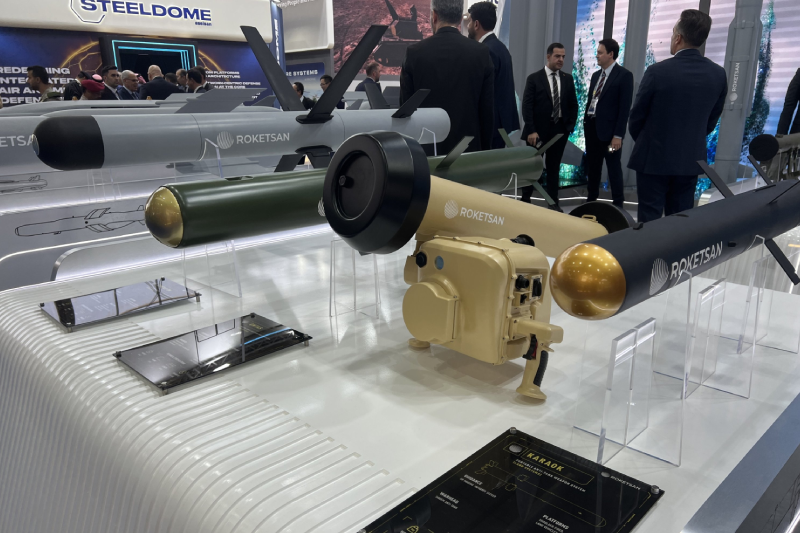

At the prestigious IDEF defense industry fair, ASELSAN showcased ten revolutionary new high-technology, high value-added products for the first time, demonstrating continued innovation leadership and technological advancement. This successful product launch reflects the company’s exceptional technological expertise and proven ability to translate substantial R&D investments into commercially viable, market-leading solutions.

The successful IDEF participation generated increased international recognition and numerous potential export opportunities. These groundbreaking product launches position ASELSAN for future contract wins while demonstrating technological superiority across multiple critical defense sectors.

Market Capitalization Achievement

ASELSAN achieved a remarkable milestone by becoming the most valuable company on Borsa İstanbul in 2025, with market capitalization exceeding $21 billion. This outstanding achievement reflects strong investor confidence in the company’s strategic direction, growth potential, and long-term value creation capabilities.

The exceptional market valuation validates ASELSAN’s successful business model and strategic execution while providing enhanced access to capital markets for future expansion initiatives. This market recognition significantly enhances the company’s ability to attract top talent and secure additional investment capital.

Also read this: Aselsan’s Systems Offered at IDEF 2025

Future Growth Strategy

CEO Akyol emphasized maintaining strong momentum throughout the second half of 2025, with plans to sustain high levels of R&D and infrastructure investment while aggressively expanding serial production capacity in critical areas including air defense systems, radar technology, smart ammunition, precision guidance systems, and advanced electro-optics solutions.

The comprehensive export-oriented growth strategy focuses on expanding into new international markets while strengthening existing customer relationships and partnerships. This balanced strategic approach maximizes domestic market leadership while pursuing aggressive international expansion opportunities across multiple geographic regions and defense sectors.

Join us on Facebook, Twitter, YouTube, Instagram, and TikTok for real-time coverage of defense events worldwide.

Discover more from International Defence Analysis

Subscribe to get the latest posts sent to your email.