Rheinmetall Buys German Shipbuilder For Naval Powerhouse

German defense giant Rheinmetall AG has announced its acquisition of Bremen-based Naval Vessels Lürssen B.V. & Co. KG from the prestigious Lürssen Group, marking a significant strategic expansion into maritime defense capabilities. The Rheinmetall NVL acquisition positions the company to dramatically expand its naval ammunition offerings and establishes a stronger presence in the rapidly growing maritime defense sector, with the Rheinmetall NVL shipyard deal expected to transform the company’s naval operations capacity and market reach.

Strategic Transaction Details

The acquisition transaction is scheduled for completion in early 2026, with both companies agreeing to maintain confidentiality regarding the specific purchase price. This strategic move represents Rheinmetall’s most significant naval expansion effort, positioning the defense conglomerate to capitalize on increasing global demand for maritime defense solutions and naval ammunition systems across international markets.

Financial Projections and Growth Expectations

Rheinmetall CEO Armin Papperger revealed ambitious financial targets for the acquired NVL operations during an analyst call on Monday. Under Rheinmetall ownership, NVL is projected to achieve approximately €300 million in EBITDA by 2027, with margins expected to grow from the current 10% to approximately 15% by 2030, demonstrating the significant value creation potential of this strategic acquisition.

Investment Valuation and Return Calculations

Papperger disclosed that Rheinmetall paid an EBITDA multiple of less than 10 for the NVL acquisition while projecting a midterm EBITDA multiple of approximately 4.5 in their strategic calculations. These metrics indicate the company’s confidence in achieving substantial returns through operational improvements, market expansion, and synergistic integration with existing Rheinmetall defense capabilities.

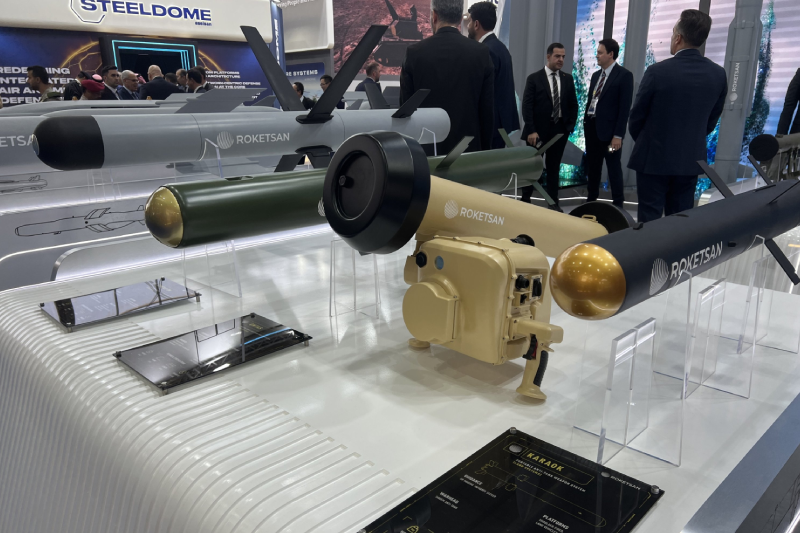

Naval Ammunition Focus and Market Opportunity

The acquisition specifically targets naval ammunition production capabilities, including rocket motor manufacturing and final assembly operations. Papperger emphasized that naval ammunition represents “the real interesting thing” about this acquisition, addressing critical supply chain bottlenecks where navies currently face years-long waiting periods for missile deliveries due to insufficient global production capacity.

Addressable Market Analysis

The CEO estimates Germany’s addressable naval defense market at approximately €53 billion through 2035, based on current draft budgets and financial planning documents. Beyond Germany, Rheinmetall identifies Italy, Greece, and Turkey as the most promising international markets, with expansion plans focused on developing strategic local partnerships to access these lucrative defense contracts.

Global Operations

NVL operates an extensive international manufacturing network including four shipyards in northern Germany, plus strategic international locations in Croatia, Bulgaria, Egypt, Singapore, and Brunei. The company employs approximately 2,100 people worldwide and generated sales of about €1 billion during the 2024 fiscal year, providing Rheinmetall with immediate global naval manufacturing capabilities.

Integration Synergies with Existing Operations

Rheinmetall anticipates significant operational synergies with its existing northern German facilities in Kiel and Flensburg, where the company currently conducts components production, quality control, and maintenance for its Vehicle Systems division. The shipyard infrastructure, specialized equipment, and maritime expertise will support vehicle chassis production capabilities, particularly in advanced steel cutting and welding operations.

Current Naval Projects and Partnerships

One of NVL’s major current projects involves the Blohm+Voss partnership with Dutch Damen Schelde Naval Shipbuilding for procurement of six F126 frigates for the German navy. While this project has experienced production delays, it demonstrates NVL’s involvement in high-profile naval programs that will benefit from Rheinmetall’s operational expertise and financial resources.

Strategic Market Positioning Advantages

The acquisition positions Rheinmetall to address critical supply chain constraints affecting global naval forces. By expanding production capacity for naval ammunition and missile systems, the company can capitalize on unprecedented demand from military customers facing extended delivery timelines from traditional suppliers, creating significant competitive advantages in the maritime defense sector.

Operational Transformation

Rheinmetall plans to leverage shipyard infrastructure to minimize excessive infrastructure investments and avoid extensive production line conversions for other business divisions. This cross-utilization strategy demonstrates the company’s commitment to maximizing operational efficiency while reducing capital expenditure requirements across its diverse defense manufacturing portfolio.

Corporate Restructuring

The NVL acquisition aligns with Rheinmetall’s broader corporate restructuring strategy, including converting civilian sites in Neuss and Berlin for arms manufacturing while planning to divest civilian operations in early 2026. This focused approach on defense capabilities reflects the company’s commitment to capitalizing on increased global defense spending and military modernization programs.

Industry Consolidation

The acquisition represents broader defense industry consolidation trends as major players seek to capture market share in growing segments. Rheinmetall’s expansion into naval capabilities through the NVL purchase positions the company to compete more effectively against established naval defense contractors while building comprehensive maritime defense solutions portfolios.

Don’t miss this: South Korea Upgrading KF-21 To 5th-Gen Stealth Jet

Future Expansion Plans

CEO Papperger has confirmed his target of achieving minimum €5 billion in naval segment sales by 2030, as previously disclosed at the DSEI defense exposition in London. This ambitious growth target demonstrates Rheinmetall’s confidence in the naval defense market’s expansion potential and the company’s ability to capture significant market share through strategic acquisitions and organic growth.

The Rheinmetall NVL acquisition represents a transformative strategic move that positions the German defense giant as a major player in global naval defense markets. Through this acquisition, Rheinmetall gains immediate access to established shipbuilding capabilities, international manufacturing networks, and critical naval ammunition production expertise that will drive significant growth in the expanding maritime defense sector while addressing urgent military customer needs for enhanced naval capabilities.

Keep connected with us at Facebook, Twitter, YouTube, Instagram & TikTok for latest defense happening around the globe.

Discover more from International Defence Analysis

Subscribe to get the latest posts sent to your email.